Overcoming Common Payment Concerns: Why Adopting a Payment Processor Is Worth It

Adopting a payment processor is a significant step for any business, yet some hesitate due to concerns about fees, setup complexity, and other potential barriers. But don’t fret—below we address the most common concerns and explain why embracing a payment processor for your appointments is worth the investment.

5 payment concerns you shouldn’t be concerned about

1. Transaction fees

Worried about transaction fees cutting into your profits? The benefits far outweigh the costs:

Increased revenue: Accepting online payments often leads to fewer cancellations and no-shows, leading to more consistent income for your business.

Improved cash flow: Payment processors handle secure transactions and automatically transfer money to your account, providing smoother and more predictable cash flow.

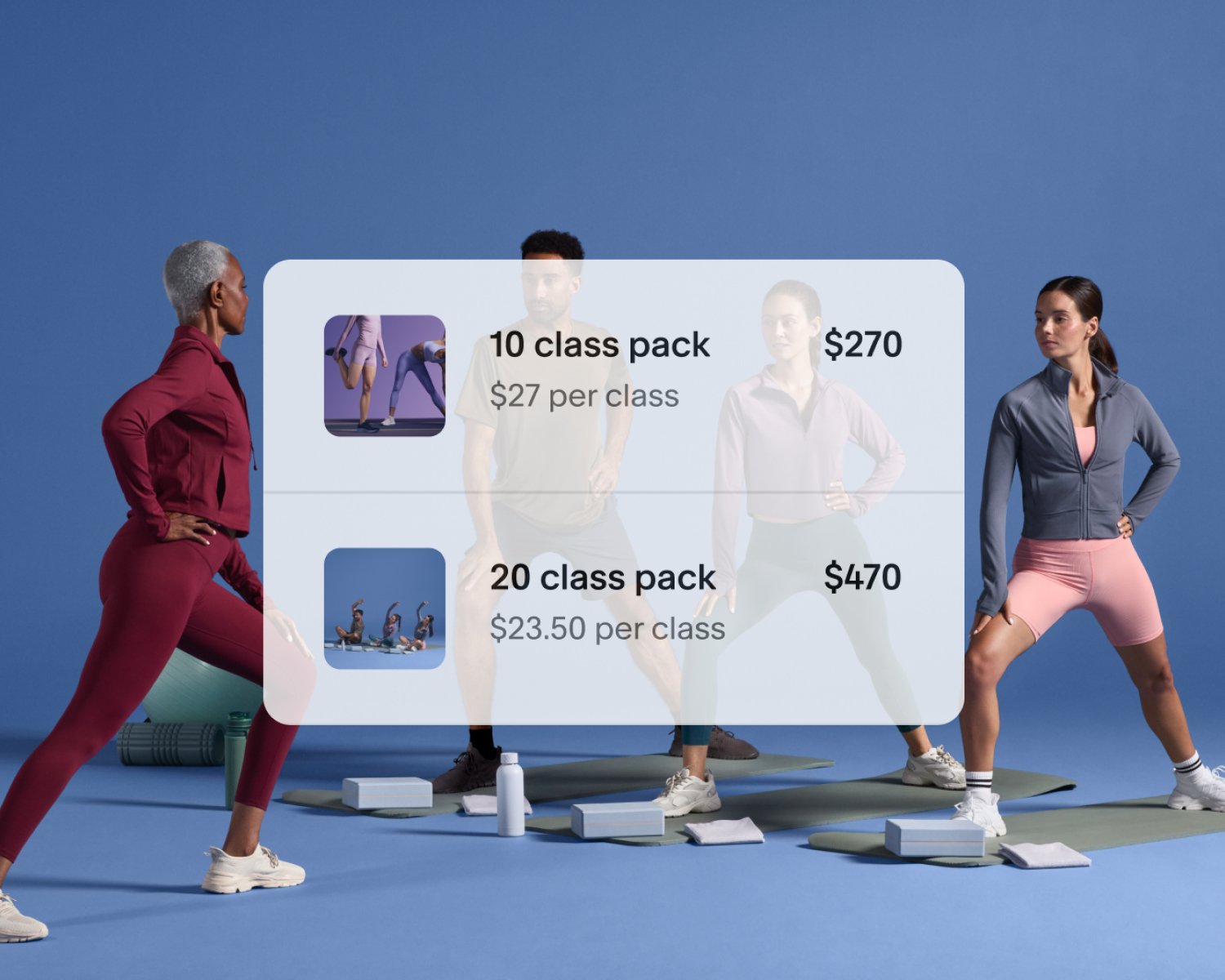

Enhanced client satisfaction: By offering diverse payment options like credit cards, Apple Pay, Google Pay, and PayPal, you make the booking process flexible and convenient, improving overall client satisfaction.

Consolidated financial tracking: Gain a clear, unified view of your business finances, making it easier to track revenue, monitor transactions, and generate reports—all from one platform.

2. Setup complexity

Setting up a payment processor can seem daunting, but with Acuity Scheduling, the process is simple and straightforward. In just a few steps, you can connect Stripe, Square, or PayPal to your account and set up your policies.

Step-by-step instructions: Acuity provides clear, easy-to-follow instructions to guide you through connecting your preferred payment processor.

Expert support resources: If you need more help, Acuity’s dedicated support team is always ready to assist, while self-guided resources help to ensure a smooth setup experience at every step.

3. Trust and security

Security is a top priority for businesses and clients when it comes to online transactions. Payment processors like Stripe, Square, and PayPal use top-tier security protocols, including encryption, fraud protection, and compliance with industry standards like PCI-DSS. This ensures that both your business and your clients are protected against security breaches and fraud, giving you peace of mind when handling transactions.

4. Client resistance

Some businesses worry that clients may resist online payments or be uncomfortable with certain payment methods. Here’s why that concern is often unfounded:

Flexibility: Offering multiple payment options, including Google Pay, Apple Pay, PayPal, and major credit cards, gives clients more flexibility and control over their experience.

Familiarity: Many clients already use these payment methods for everyday purchases, making them comfortable and convenient choices. Offering familiar and secure payment methods can build trust and boost client satisfaction.

5. Confusion about payment methods

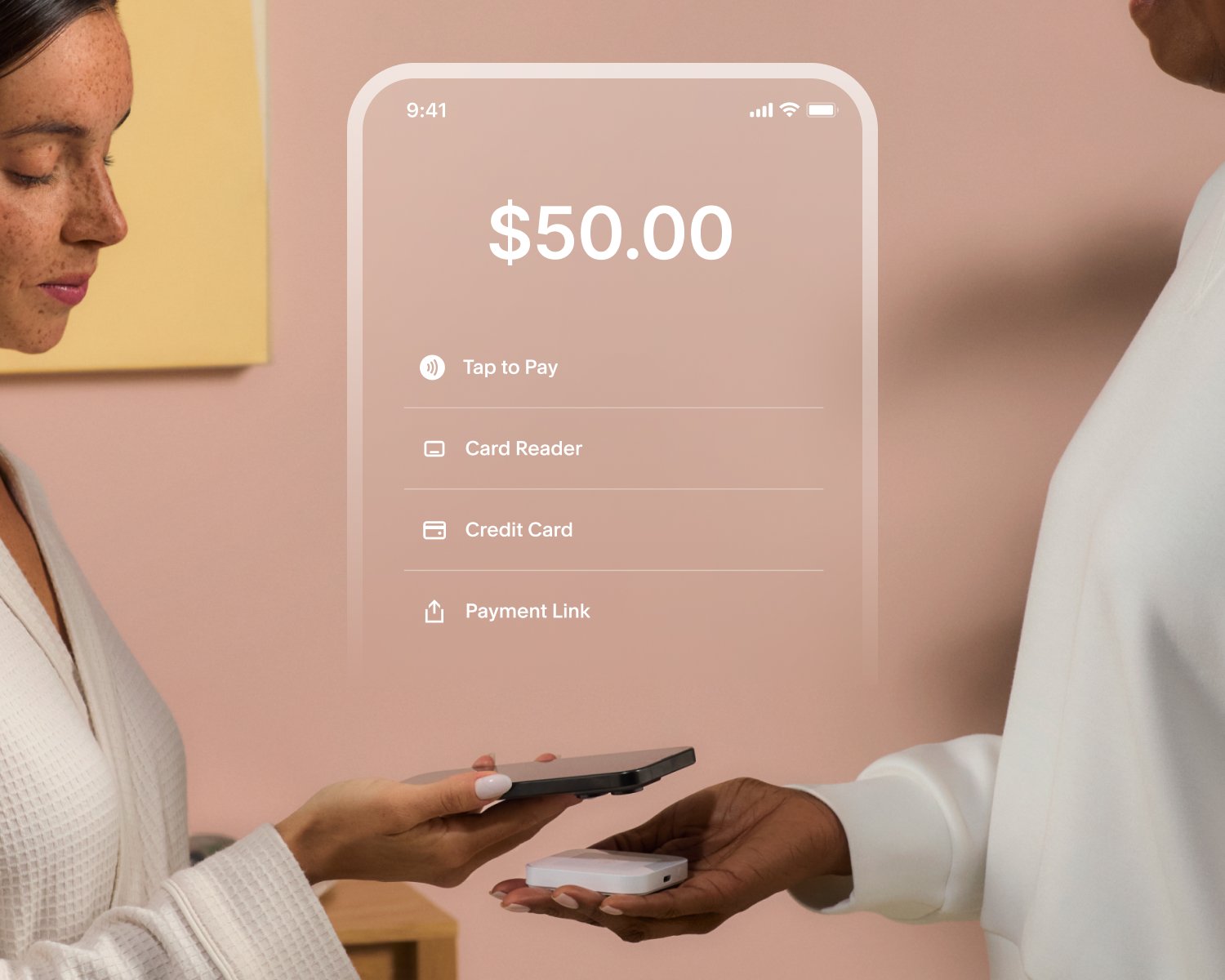

Some businesses may be uncertain about which payment processor or methods to choose. This uncertainty often leads to inaction. With Acuity’s powerful payment integrations, you’re covered no matter your needs. For example, Stripe supports online payments, Google Pay, and Apple Pay, while Square offers in-person payments with card readers, and PayPal’s trusted global platform can support your international needs.

Use our payment processor checklist to find the best option for your business model.

Why you should adopt a payment processor today

Connecting a payment processor to your scheduling software offers tangible benefits that outweigh these initial concerns, including:

Streamlined operations for both online and in-person transactions.

Enhanced client experience with flexible, secure payment options.

Increased revenue and reduced no-shows with upfront payments or deposits.

Greater financial clarity through consolidated tracking and reporting tools.

Smarter payments, less stress

Don’t let payment concerns hold your business back. With Acuity Scheduling, integrating a payment processor like Stripe, Square, or PayPal is simple and effective, allowing you to focus on what you do best—delivering excellent service.

Experience the difference today.