Why You Need a Payment Processor and How to Choose the Right One for Your Business

Managing payments shouldn’t slow you down—or complicate the client experience. Acuity Scheduling integrates with top payment processors to streamline how you collect payments, reduce no-shows with payment tools, and offer your clients secure and flexible ways to pay.

This guide will help you choose and connect the right payment processor for your business, so you can manage payments effortlessly.

What is a payment processor and why is it important?

A payment processor allows you to accept payments directly through Acuity, streamlining your business and offering clients secure and flexible ways to pay. Accepting payments online and in person not only improves your cash flow but also reduces no-shows, protects against lost revenue, and enhances client satisfaction with smoother checkout options.

What are the benefits of payment processors?

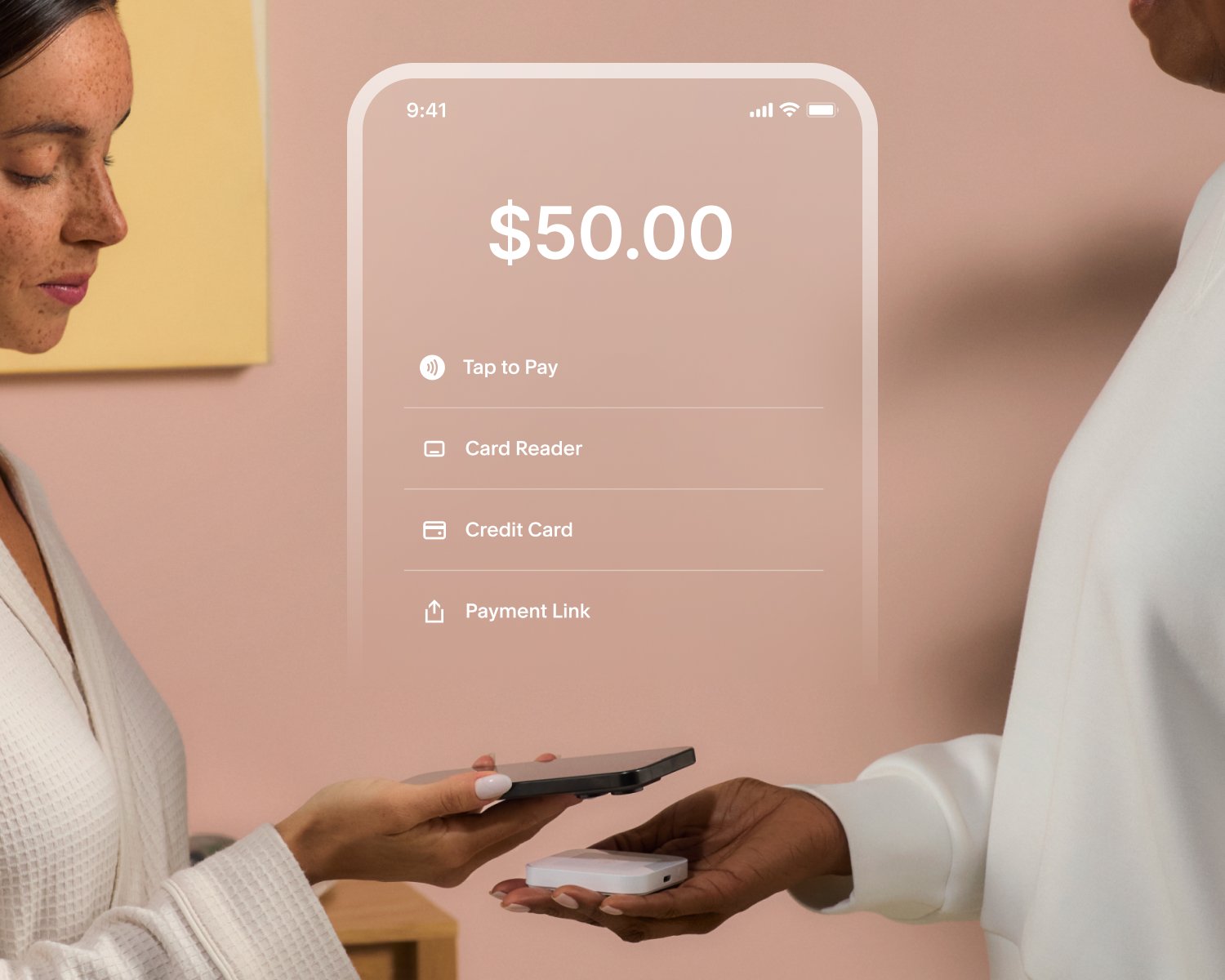

Accept in-person payments with ease: Offer a smooth, face-to-face payment experience with Acuity’s integrated payment processors. Whether clients pay by tapping a contactless card, using their smartphones, or swiping through a card reader, you can accept payments without friction. For cash transactions, easily track and mark appointments as paid directly in Acuity.

Optimize the client experience with flexible payment options: Customize how and when clients pay for appointments, providing them with a range of options like paying upfront, making deposits, or saving their card details for future charges. With Google Pay, Apple Pay, and tips* at checkout, you make payments as simple and convenient as possible, ensuring clients leave satisfied.

Reduce no-shows with prepayments and deposits: Require prepayments or deposits when clients book their appointments, increasing their commitment and reducing no-shows. Storing credit card details also makes it easy to charge fees for cancellations or missed appointments, protecting your business from lost revenue.

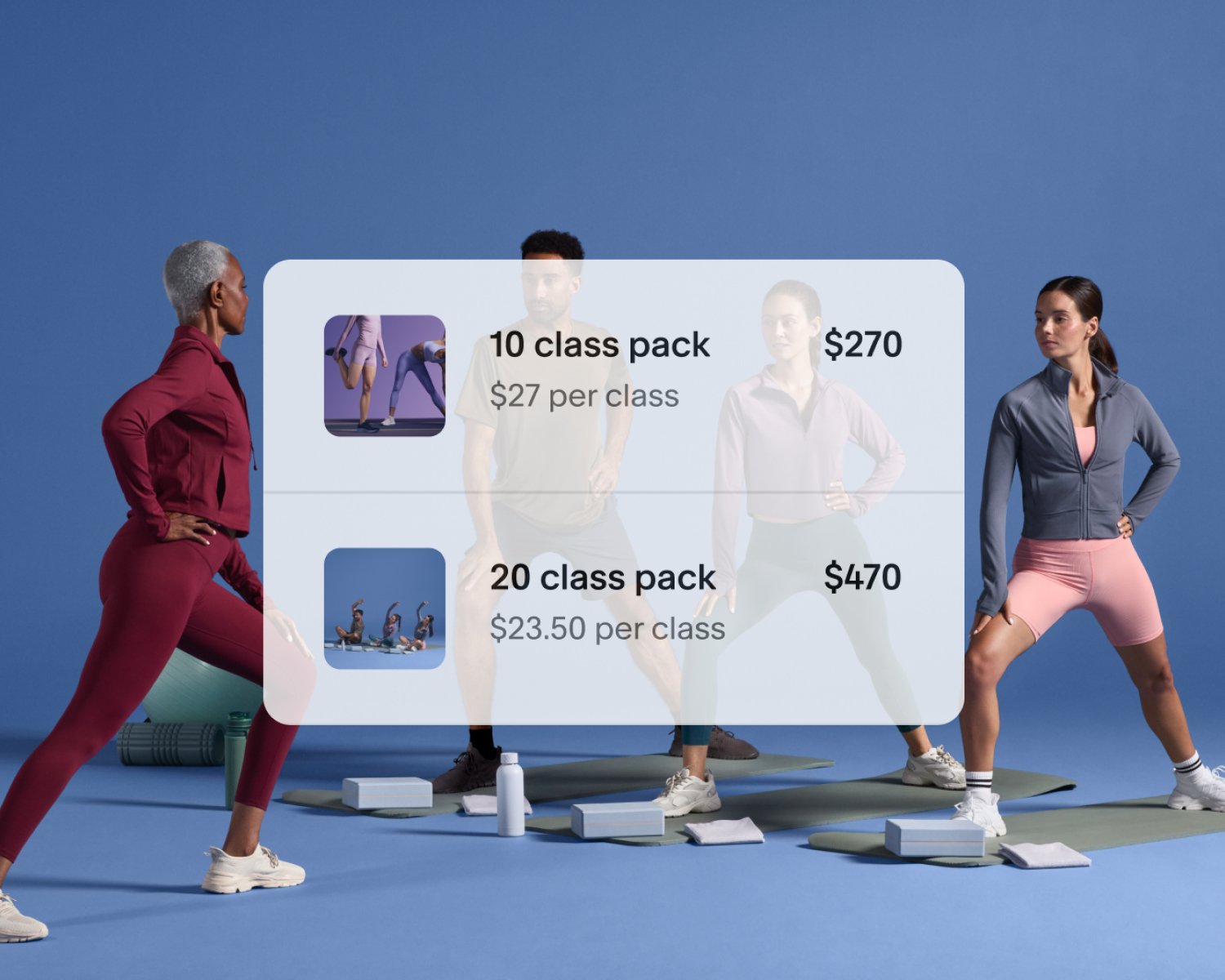

Unlock new revenue streams: Boost your earnings by offering packages, gift certificates, and subscriptions. These features not only drive repeat bookings but also foster client loyalty, making it easier for clients to commit to recurring services while generating predictable revenue for your business.

Look more professional with custom invoicing: Streamline your billing process by creating and sending professional invoices directly through Acuity. Customize invoices with your business branding, and manage all your invoices from a unified dashboard, making it easy to track payments and ensure you get paid.

Connect online and offline payment workflows: Manage payments from start to finish without any hassle. Accept deposits online, calculate remaining balances automatically after appointments, collect final payments in person, and reconcile everything in Acuity, ensuring accurate and smooth transactions.

Understanding your payment processor options

Acuity integrates with three main payment processors: Square, Stripe, and PayPal. Each option offers unique features, fees, and user experiences to meet the needs of different businesses:

Square is suited for businesses that accept both in-person and online payments. It integrates with card readers (U.S. only) and, similar to Stripe, offers simple, all-in-one solutions for handling payments. This includes secure payments, tipping, deposits, subscriptions, and storing card information.

Accept in-person payments with card readers (U.S. only).

Prevent no-shows with secure card vaulting and deposits.

Pay directly on your scheduling page with major credit cards.

Enable tipping and offer subscriptions.

Enable clients to pay and tip via contactless payment links sent to their mobile devices.

Stripe offers flexibility by allowing clients to pay directly on your scheduling page using Google Pay, Apple Pay* and all major credit cards for a seamless experience. You can enable tipping, offer memberships or subscriptions, and prevent no-shows by storing card information, as well as offering prepayments and deposit options. Additionally, you can accept in-person payments using Acuity’s mobile app with Stripe’s Tap to Pay compatibility, expanding your payment options beyond online transactions.

Pay directly on your scheduling page with Google Pay, Apple Pay, and major credit cards.

Prevent no-shows by storing card information and offering prepayments and deposits.

Enable tipping and offer memberships or subscriptions.

Accept in-person payments with Tap to Pay compatibility.

Enable clients to pay and tip via contactless payment links sent to their mobile devices.

PayPal can be connected in addition to other payment processors, and is best for businesses with international clients or those who prefer PayPal's global recognition. PayPal is easy to set up and ideal for clients who prefer paying with their bank account or PayPal balance, although it redirects clients to PayPal’s site for payments. You can accept tips*, but can’t store card details or offer recurring payments with subscriptions.

Clients are redirected to PayPal to complete payments.

Accept tips (if using the new scheduler).

Ideal for clients who prefer using their PayPal balance or bank account.

Does not support card vaulting or subscriptions.

Note:

You can connect PayPal with either Stripe or Square.

Stripe and Square cannot be connected at the same time.

Transaction fees for appointment payments

Acuity does not charge any additional fees on top of the transaction fees from the payment processors. Each processor has its own fee structure for transactions; visit their official websites for the most accurate details. Consider how these fees align with your revenue model and customer preferences when making a decision.

How to choose the right payment processor

Choosing the best payment processor for appointments depends on your business model, how you want clients to pay, and which features are most important to you. Use this checklist to compare Square, Stripe, and PayPal and choose the payment processor that best suits your needs:

Want to accept payments directly on your scheduler?

Choose Stripe or Square

Both Stripe and Square allow clients to pay directly on your Acuity scheduling page without leaving the site, making the payment process seamless and user-friendly.

Why this matters: Keeping clients on your scheduler reduces the chances of payment drop-offs and creates a more professional and integrated experience.

Need to accept in-person payments?

Choose Square or Stripe

If you frequently accept in-person payments, such as at a physical location or event, Square’s card readers allow you to swipe or tap cards for in-person transactions. This feature is available when using the Acuity mobile app in the U.S. You can also use Stripe’s Tap to Pay feature to accept payments in person. Both Square and Stripe enable clients to pay and tip via contactless payment links sent to their mobile devices.

Why this matters: For businesses with a physical presence or those conducting appointments on the go, being able to accept in-person payments can streamline operations and offer flexibility for clients who prefer to pay face-to-face.

Clients prefer PayPal?

Choose PayPal

PayPal is globally recognized and trusted by millions of users. If your clients prefer PayPal or want to pay via their bank account or PayPal balance, this might be the best option. Keep in mind that clients will be redirected to PayPal.com to complete the payment before being brought back to your scheduler.

Why this matters: Offering PayPal can attract clients who are more comfortable using this platform, especially for international clients or those wary of entering their card information on a scheduler.

Offering subscriptions or storing credit card details?

Choose Stripe or Square

Both Stripe and Square allow you to store client credit card information (known as "vaulting") securely for future charges, making it easier to handle recurring payments or collect fees for no-shows. Additionally, these processors allow you to offer subscriptions, which is a great option for businesses that provide ongoing services like memberships or recurring appointments.

Why this matters: Vaulting cards and offering subscriptions provide greater payment flexibility for both you and your clients. You can charge clients automatically for services when using appointment subscriptions, reducing manual billing efforts and improving cash flow consistency.

Want to offer Google Pay or Apple Pay at the time of booking?

Choose Stripe

If you’d like to give your clients the convenience of paying with Google Pay or Apple Pay* at the time of booking, Stripe is your best option. This feature is automatically enabled when you connect to Stripe and is available for clients who have these digital wallets set up.

Why this matters: Digital wallets like Google Pay and Apple Pay offer convenience for clients, allowing them to check out faster with saved card information. This can enhance the user experience and reduce friction during the booking process.

Looking for a simple, all-in-one solution to accept in-person and online payments?

Choose Square or Stripe

Both Square and Stripe are excellent choices for businesses that need to accept payments both online and in person. Each integrates directly with Acuity, allowing you to manage payments without redirecting clients away from your scheduler. Stripe supports Tap to Pay and a range of advanced online payment features, while Square provides in-person card readers (U.S. only) for seamless face-to-face transactions.

Why this matters: For businesses offering both digital and physical services—such as salons, fitness studios, or consultants with a mix of online and in-person appointments—Stripe and Square both offer flexible and unified solutions to manage all payments in one place, creating a smooth experience for your clients.

Quick summary: Stripe vs. Square vs. PayPal feature comparison

| Feature | Stripe | Square | PayPal |

|---|---|---|---|

|

Pay directly on scheduler

|

Sim | Sim |

No (redirected to PayPal.com)

|

|

Pay after booking

|

Sim | Sim | Não |

|

Aceite gratificações

|

Sim | Sim | Yes (with the new scheduler) |

|

Store credit card info

|

Sim | Sim | Não |

|

Accept deposits

|

Sim | Sim | Yes (but no further payments after booking) |

|

Card reader

|

No (app only; no card reader support) | Yes* (U.S. only) | Não |

|

Subscriptions & Memberships

|

Sim | Sim | Não |

|

Google Pay & Apple Pay

|

Sim | Não | Não |

|

Redirect to external site for payment

|

Não | Não | Yes (redirected to PayPal.com) |

|

Accepted payment methods

|

Visa, MasterCard, American Express, Discover, Diner's Club, JCB, Google and Apple Pay | Visa, MasterCard, American Express, Discover, Diners, JCB, UnionPay | Bank account, Visa, MasterCard, Discover, American Express, PayPal balance |

|

Tap to Pay compatible with Acuity mobile app

|

Sim | Não | Não |

How to set up your payment processor in Acuity

Here’s how you can connect a payment processor:

Go to payment settings: Navigate to your Acuity account and click on Payment Settings in the left-hand menu.

Choose your payment processor: Select Stripe, Square, or PayPal and follow the prompts to connect your account.

Complete setup: After connecting, you’ll have access to flexible payment options for your appointments, subscriptions, and more. Learn how to set up your policies.

Ready to get paid faster?

Connecting a payment processor to Acuity Scheduling simplifies your payment workflows and enhances client satisfaction. Get started and get paid today.

*Google Pay, Apple Pay, and tips are only available to users on the new scheduler.